Birthplace & Historical Archive of Multicapitalism & Context-Based Accounting

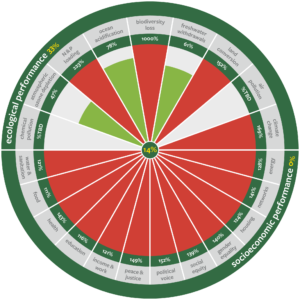

Illustration of Context-Based vs. Conventional Accounting

World’s 1st Context-Based

Triple Bottom Line Methodology

.

2012 Book-Length Intro to

Context-Based Sustainability

.

Corporate sustainability is fundamentally about responsibilities companies have to respect the rights of others to vital resources in the world and to manage their own performance in those terms!

Time to Declare a Planetary Accounting Emergency!

As if the Planetary Climate and Coronavirus emergencies were not enough, we now have a Planetary Accounting Emergency to contend with as well – a chronic and widespread failure of performance accounting in the public and private domains to tell us the truth. See this important article on the subject in the journal Solutions (Dec. 2020), Time to Declare a Planetary Accounting Emergency, in which the performances of five well-known pubic companies were reported in both Single and Triple Bottom Line terms. The differences between the two ways of revealing performance are striking!

UN Calls For ‘Authentic’ Triple Bottom Line Accounting

The United Nations is now openly advocating for context-based accounting in a report issued by UNRISD in late 2022, entitled: Authentic Sustainability Assessment: A User Manual for the Sustainable Development Performance Indicators. Largely based on Context-Based Sustainability, a rigorous and distinctive approach to sustainability measurement developed by CSO Director Mark W. McElroy in 2008, the UN report is the first international effort to specify a multi-bottom-line range of context-based indicators for use by organizations around the world. Related training is now being offered by CSO and r3.0. See here for info.

What is Context-Based Sustainability (CBS)?

If you’re new to Context-Based Sustainability (or CBS) – sometimes referred to as Context-Based Accounting – or just a little rusty on the subject, take a look at this short tutorial: The Essence of CBS, and also this Wikipedia page that explains the concept in more detail.

Generally Accepted Integrated Accounting (GAIA) Principles

CSO is very pleased to share its proposal for the world’s first articulation of Generally Accepted Integrated Accounting (GAIA) Principles. Just as financial accounting is grounded in GAAP and IFRS, so must there be a set of generally accepted principles for integrated and non-financial accounting – sustainability accounting, too. No such principles, however, have been formally adopted and yet they do exist. A full presentation of our thinking can be found here.

Elkington Hails ‘Long-Awaited’ Triple Bottom Line Platform

First came Certified B Corps and Benefit Corporations. Now come “Certified TBL Orgs”, a company-level credential that recognizes and rewards organizations that have successfully implemented world-class Triple Bottom Line (TBL) accounting functions. As co-developer of this concept with Social Accountability International (SAI), we are very pleased to be able to share an independent review of it by the creator of the Triple Bottom Line concept himself, John Elkington:

“When I coined the term Triple Bottom Line back in 1994, I imagined integrated and increasingly systemic solutions to the sort of challenges later outlined in the UN Sustainable Development Goals. The reason I launched the first-ever ‘product recall’ for a management concept in 2018, in this case for the TBL, was that the mainstreaming and capture of such concepts and frameworks was diluting their original intent. At the time I didn’t yet know what the best way forward would be, but in another example of ‘You know it when you see it’ I now see Mark McElroy’s work with Social Accountability International (SAI) as the beta version of the operating code of the long-awaited platform on which the future of TBL strategy, management, valuation, accounting and reporting can now be built.” (May, 2023)

John Elkington, Founder & Chief Pollinator, Volans Ventures, and pioneer in Triple Bottom Line thinking

Rights, Duties and Corporate Social “Kantracts”

CSO is pleased to announce the introduction of Corporate Social “Kantracts” (CSKs), a cutting-edge evolution of integrated accounting developed by its Founding Director, Mark W. McElroy. As Dr. McElroy explains in Rights, Duties and Corporate Social “Kantracts”, CSKs address the implicit normative foundations of performance accounting by making them explicit, and in a way that also brings Kantian ethics into play.

Thresholds, Allocations & the Carrying Capacities of Capitals

Having hosted, starting in 2005, our Founding Director’s creation of what today is regarded as best practices in sustainability accounting – the specification of thresholds, allocations and the carrying capacities of capitals – we are pleased to share Dr. McElroy’s synthesis of his thinking in these areas, the intellectual history that preceded them, and a commentary of his own on recent events in the field: Thresholds, Allocations and the Carrying Capacities of Capitals: Core Principles in Sustainability and Integrated Accounting.

Why ‘Context-Based’ and not ‘Science-Based’?

We are often asked why we use the term context-based instead of science-based in our work, as if science-based would be preferable. The answer is twofold. First, not all sustainability targets involve science at all. Many instead are grounded in ethics, such as for racial and gender equality, targets for which have more to do with fairness, justice and equity than with empirical facts in the world. Second is that even for science-based environmental targets, allocations of shared responsibilities to achieve them must be made – in which case we are once again talking about fairness, justice and equity, not science. Thus, whereas context-based accounting addresses science and ethics together, science-based accounting does not. From a sustainability accounting perspective, then, science-based thinking, while important, is not enough. Context-based thinking, by contrast, is more complete. For more about this, see here and here.

Think Pies Not Doughnuts!

While the Doughnut Economics concept has attracted much well-deserved attention over the years, we’ve long felt that certain improvements to it were needed. We’re pleased to announce, therefore, an alternative graphical reporting tool that we call Pie Slice Accounting. And unlike the Doughnut Economics program, which prohibits organizations from using it, we welcome them! So Think Pies, Not Doughnuts.

‘Performance implies ought’

‘Performance implies ought‘ is a philosophical principle, or maxim, put forward by CSO founder Mark W. McElroy in 2023, according to which an agent’s actions or inactions can be normatively assessed if and only if corresponding duties or obligations obtain. One cannot be judged, that is, by standards of performance that do not legitimately apply in the first instance. Unlike impact valuation for discretionary, charitable or purely incidental impacts, performance accounting per se is predicated upon non-discretionary duties and obligations and is effectively a form of responsibility accounting. The ‘ought implies can’ principle also comes into play here, albeit for different reasons. Indeed, the two principles are closely related, yet different.

Introducing the Von Carlowitz Project

We and many others sometimes speak of the need for a kind of Manhattan Project in sustainability, a go for broke initiative aimed at transforming commerce from its currently unsustainable form to a new more tenable one. For us, multicapitalism provides exactly the sort of vision we need, and The Von Carlowitz Project can help us get there from here!

The Center for Sustainable Organizations

What differentiates CSO from others in the sustainability arena is its strong commitment to an approach for corporate sustainability measurement, management and reporting that is context- and multicapital-based